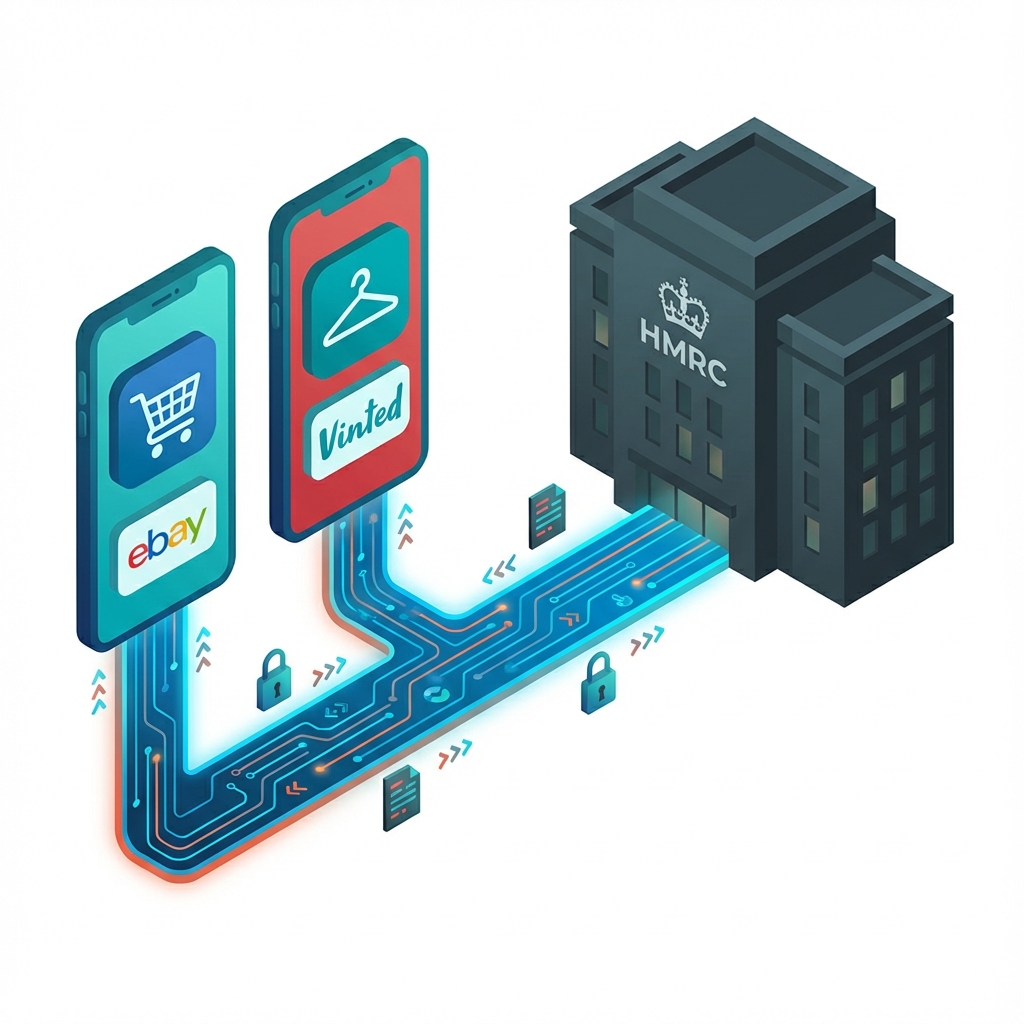

HMRC Knows What You Sold.

The days of "under the radar" cash sales are over. Digital platforms are now legally required to send your sales data directly to the tax man.

The "Side Hustle Tax" Trap

Since January 1st, 2024, platforms like eBay, Vinted, Etsy, Depop, and Airbnb must collect and report user data to HMRC under the OECD model rules.

This isn't just about big businesses. If you are a casual seller, your name, address, date of birth, and National Insurance number can be handed over automatically.

⚠️ Myth Buster: "It's just my personal stuff."

HMRC systems use AI to flag "trading behavior". Frequent sales, even of "personal" items, can trigger an investigation if the data doesn't match your tax return.

The Triggers

If you hit EITHER of these thresholds on a single platform within a calendar year, your data is sent to HMRC.

30 Items

Sold in 1 year

Even if you only sell 30 cheap items for £1 each, you trigger the reporting requirement.

€2,000

Approx £1,700 in Sales

Total gross sales (including shipping fees!) across the year.

Don't Confuse "Reporting" with "Taxable"

Reporting (The Spy)

The thresholds above (30 items / €2000) are just for data sharing. Hitting them doesn't automatically mean you owe tax, but it means HMRC knows about your income and expects you to justify it.

Tax Liability (The Bill)

You generally only owe tax if you are "Trading" (buying/making to sell) AND your total gross trading income exceeds the £1,000 Trading Allowance.

The Danger Zone

The danger arises when platforms report you (because you hit 30 items) but you haven't filed a return because you thought you were "safe". HMRC computers will spot the mismatch and send a penalty notice.

Are You Safe?

Don't wait for the brown envelope to land on your doormat. Check your audit status in 2 minutes.

Launch Audit Calculator